The smart Trick of The Wallace Insurance Agency That Nobody is Talking About

Wiki Article

The Greatest Guide To The Wallace Insurance Agency

Table of ContentsGet This Report about The Wallace Insurance AgencyThe Ultimate Guide To The Wallace Insurance Agency5 Easy Facts About The Wallace Insurance Agency DescribedThe Facts About The Wallace Insurance Agency RevealedThe smart Trick of The Wallace Insurance Agency That Nobody is Talking AboutThe Facts About The Wallace Insurance Agency RevealedThe Wallace Insurance Agency for DummiesThe Single Strategy To Use For The Wallace Insurance Agency

These strategies additionally use some defense element, to assist make sure that your recipient receives financial payment needs to the regrettable happen throughout the period of the plan. Where should you begin? The easiest method is to start considering your concerns and requirements in life. Below are some concerns to get you began: Are you searching for greater hospitalisation protection? Are you concentrated on your family's health? Are you trying to save a good sum for your kid's education and learning demands? Most individuals begin with among these:: Against a history of climbing medical and hospitalisation prices, you could desire broader, and greater insurance coverage for clinical expenditures.Ankle joint sprains, back strains, or if you're knocked down by a rogue e-scooter motorcyclist., or usually up to age 99.

How The Wallace Insurance Agency can Save You Time, Stress, and Money.

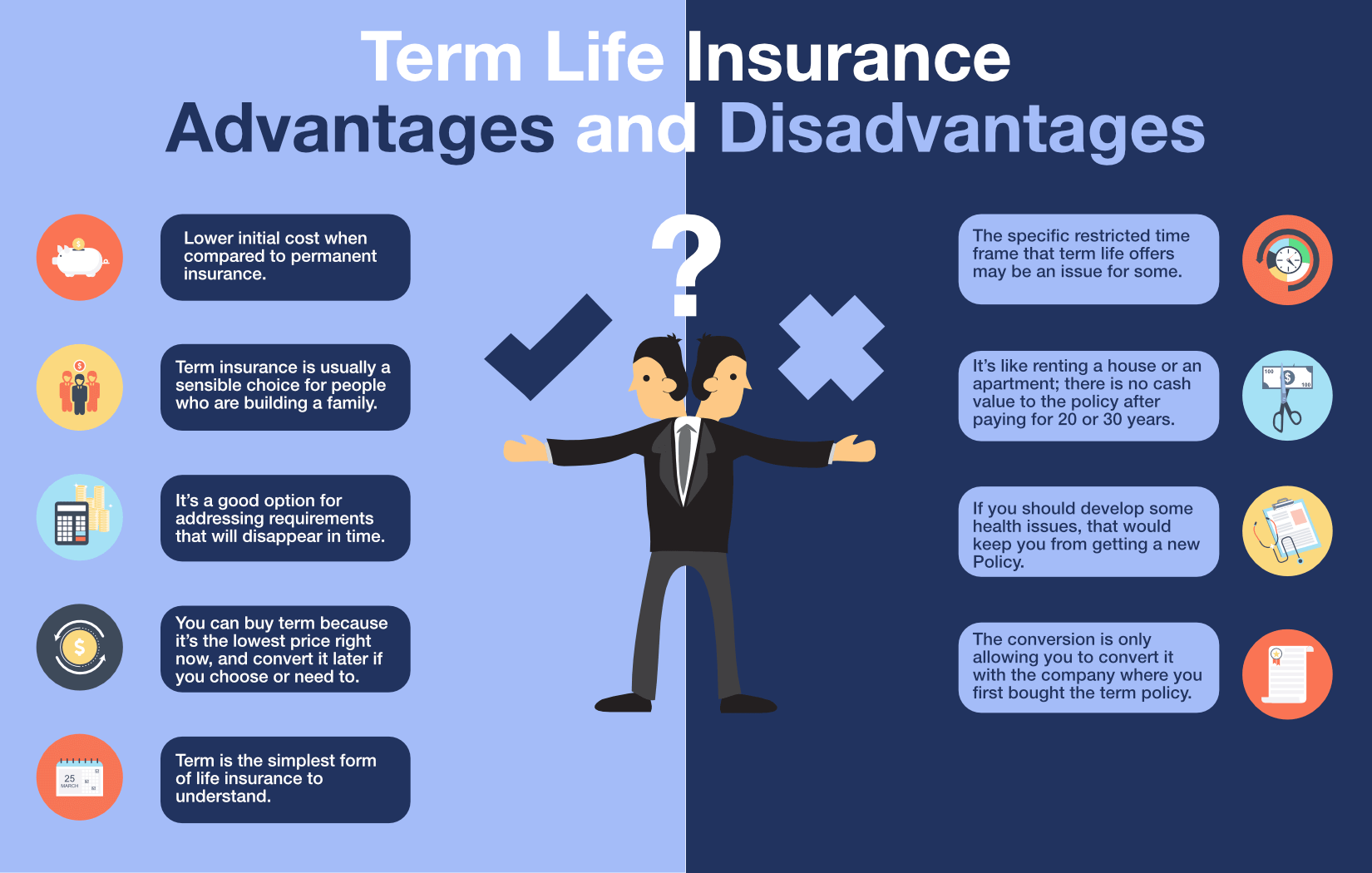

Depending on your insurance coverage plan, you get a lump amount pay-out if you are completely handicapped or critically ill, or your liked ones get it if you pass away.: Term insurance coverage supplies insurance coverage for a pre-set duration of time, e - Home insurance. g. 10, 15, two decades. Due to the fact that of the much shorter insurance coverage duration and the absence of money worth, costs are normally less than life plans, and provides yearly money benefits on top of a lump-sum quantity when it grows. It typically includes insurance coverage versus Overall and Long-term Impairment, and death.

More About The Wallace Insurance Agency

You can select to time the payout at the age when your child mosts likely to university.: This gives you with a regular monthly revenue when you retire, usually on top of insurance coverage coverage.: This is a way of conserving for short-term objectives or to make your money work harder versus the forces of inflation.

Excitement About The Wallace Insurance Agency

While getting different policies will certainly offer you a lot more extensive insurance coverage, being overly safeguarded isn't an advantage either. To prevent undesirable financial stress and anxiety, compare the plans that you have versus this list (Home insurance). And if you're still unsure about what you'll need, just how much, or the kind of insurance to obtain, consult a financial consultantInsurance coverage is a long-term dedication. Always be sensible when choosing on a plan, as switching or terminating a strategy too soon generally does not yield financial advantages.

All About The Wallace Insurance Agency

The finest part is, it's fuss-free we instantly function out your cash moves and supply money tips. This article is suggested for info just and must not be relied upon as economic advice. Before making any type of decision to acquire, offer or hold any type of financial investment or insurance coverage product, you need to inquire from a click resources monetary advisor concerning its suitability.Spend only if you recognize and can monitor your financial investment. Diversify your financial investments and prevent spending a big section of your cash in a single product issuer.

Rumored Buzz on The Wallace Insurance Agency

Life insurance coverage is not constantly one of the most comfortable topic to discuss. However simply like home and car insurance policy, life insurance policy is necessary to you and your family's monetary protection. Parents and working grownups generally need a type of life insurance policy plan. To aid, allow's discover life insurance in extra information, just how it works, what value it might offer to you, and just how Financial institution Midwest can aid you locate the right plan.

It will certainly assist your household settle financial debt, get income, and get to major monetary goals (like college tuition) in the occasion you're not right here. A life insurance plan is fundamental to planning out these economic considerations. For paying a month-to-month costs, you can get a set amount of insurance policy coverage.

Not known Facts About The Wallace Insurance Agency

Life insurance is best for almost everyone, even if you're young. People in their 20s, 30s and even 40s typically ignore life insurance policy.The even more time it requires to open up a plan, the even more danger you encounter that an unanticipated event could leave your family without coverage or financial help. Relying on where you go to in your life, it is essential to understand precisely which kind of life insurance policy is best for you or if you require any type of whatsoever.

The Wallace Insurance Agency - The Facts

A house owner with 25 years continuing to be on their home mortgage may take out a plan of the same size. Or allow's claim you're 30 and strategy to have children soon. Because instance, registering for a 30-year policy would certainly secure your costs for the following three decades.

Report this wiki page